Share your work and start earning.

Join Shutterstock's global community of contributors and earn money doing what you love.

Get startedBecome a Contributor

Create

Produce high-quality images and videos for our customers to download.

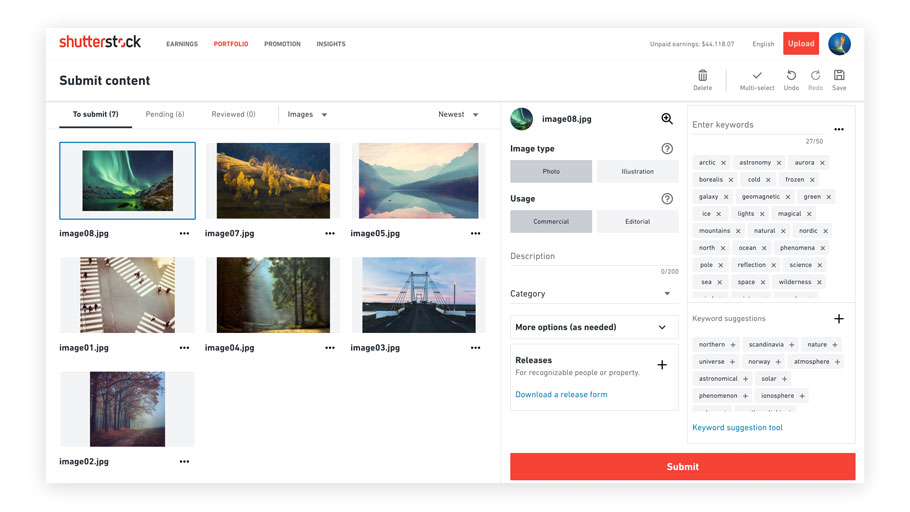

Submit

Upload your content with our easy-to-use platform, and get tips for success.

Get paid

Make money every time your content is downloaded by one of our worldwide customers.

Refer

Earn even more by referring new contributors and customers.

More than $1 billion paid out

Over the last 15 years, we’ve paid out a billion dollars to our worldwide community of contributors.

Join now

Join our global community

Showcase your work and grow your skills by joining our international community. We offer tools, tips, and support to help artists around the world earn even more.

See global earnings

Easy-to-use tools

Quickly upload and submit your content, create and share your personalized portfolio page, and easily track your earnings with our smart tools.

Explore toolsView our resources

Earn more through our other contributor platforms

Global marketplace

Shutterstock gives millions of customers access to your work. See your content around the world — even on billboards or in movies.

Join now

Get the contributor app

Upload and submit images straight from your mobile device and track your activity and earnings, all while on the go.

Learn more